After 26 years, one of Ghana’s influential players in the securities industry takes a bow. Over the years, CAL Brokers has led, and in some cases co-sponsored securities issue for clients across the spectrum. In 2004 it joined with Databank to co-sponsor its parent company in an Initial Public Offering that saw a successful issue of 27 million shares of no par value. In 2009, they co-managed (with IC Securities and New world Renaissance Securities) a renounceable right issue of 150 million shares at GH¢0.20 per share with CAL Bank as client. Meridian Marshalls Holdings (Ticker: MMH) was added to the record of clients in 2015. As an innovator, CAL Brokers pioneered the first online brokerage platform in Ghana, iBrokers, which allowed investors to trade securities from the comfort of the private space. Empires rise and fall, so do nations and economic enterprise. But the fall of CAL Brokers is one that merits inquiry because of the broad ramifications. Did the brokerage subsidiary of CAL Bank have this coming? Was there an alternative? Should banks with similar business models be concerned?

My goal in writing this piece is two-fold: first, to examine the performance trends of CAL Brokers as a way to explain management’s decision to exit the securities business, and secondly, to appreciate whether the problem is firm-specific or symptomatic of a market with declining economics. As a way to contextualize, I will review the current market reforms and also bring to the fore some emerging issues that have anchored investor confidence in a positive outlook.

Was CAL Brokers a Dog or a Question Mark?

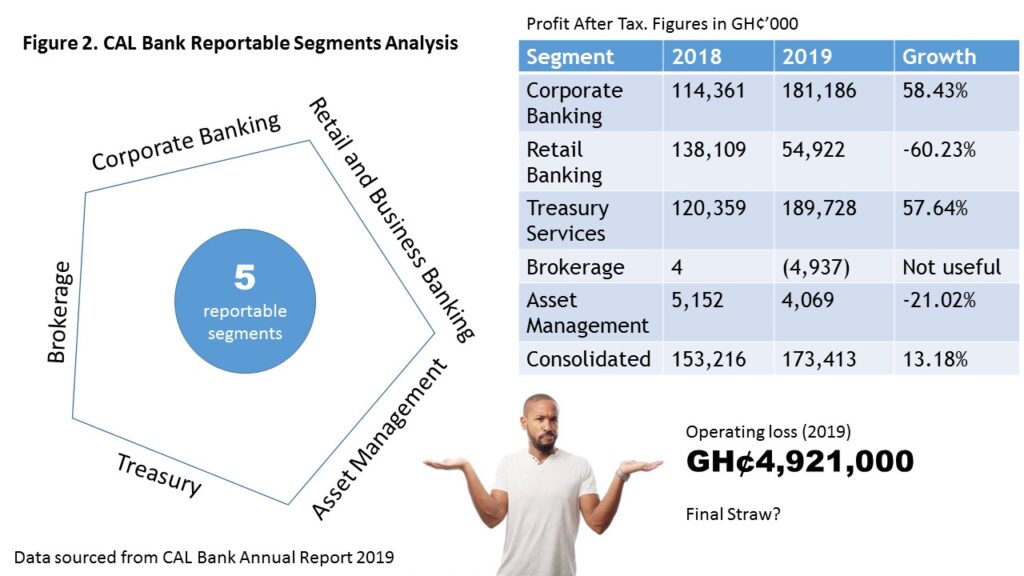

The growth/share matrix provides a sound theoretical framework for understanding management’s decision to axe the brokerage subsidiary of CAL bank. Extrapolating growth and market share trends, the framework provides a rational basis for capital allocation decisions. From a purely internal perspective, it is clear that the brokerage division was the laggard in terms of overall contribution to the revenue pot. In 2018, albeit CAL Brokers contribution to the group’s consolidated revenue was 0.73%, its contribution to the group’s GH¢153.2 million post-tax profit was a paltry 0.003%.

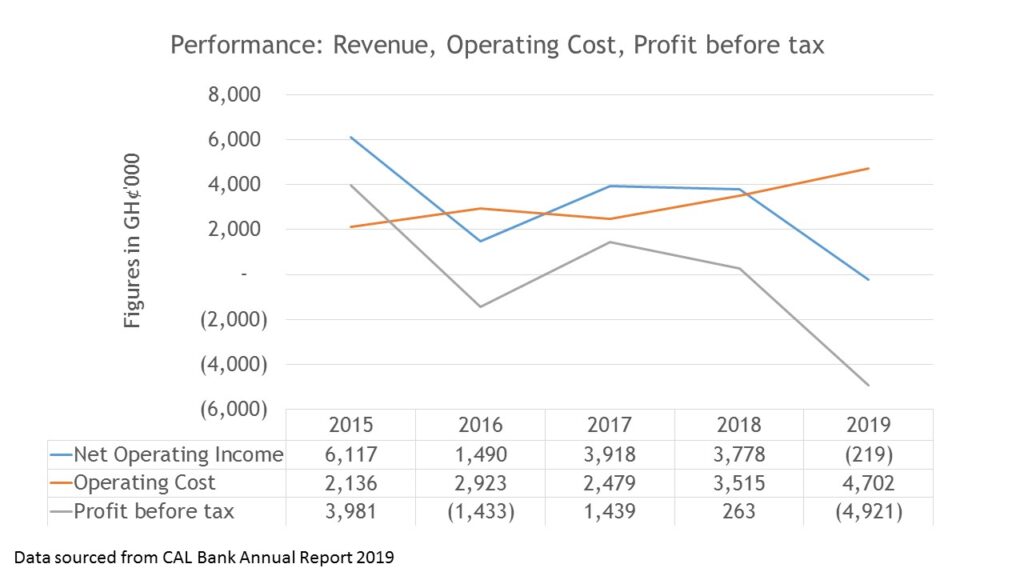

’s 2019 operating loss of GH¢4.9 million (see Figure 2) may have been the last straw that broke Phillip Wiredu’s back, seeing that the prior year’s performance had very little margin for fiscal maneuvering. Root cause analysis may point to the market cycle as the chief culprit, but a careful trend analysis cannot ignore the issue of weak cost management. After a spike in the cost-income ratio to 196% in 2016 from 34.92% in 2015, another cost surge in 2018 increased its cost-income ratio to 93.04% from 63.27% in the prior year, 2017. See Figure 3. Extrapolating from prior years starting in 2015, Admin and General Expenses seem to constitute a major part of total operating cost, about 56%.

It is instructive to note also that revenue performance saw a marked decline in net interest income from GH¢622,000 to GH¢265,000 in 2019.

The decision to self-liquidate CAL Brokers, from a financial standpoint point appears to be a sound one, albeit the question remains as to how this came about.