On June 03, 2025, the Central Bank published a statement purporting to be remarks made by Dr. Johnson Pandit Asiama, the governor of the Bank of Ghana, during the latter’s post-MPC meeting with CEOs of Banks. The statement heralded five (5) key regulatory initiatives to be introduced very soon, according to the governor. Yieldera Policy Institute fully supports the governor’s call for greater transparency and market discipline. We find it to be consistent with global best practice in risk-based supervision and regulation. That notwithstanding, there are legitimate concerns regarding certain aspects of the policy package. Based on insights from our work in the bank and non-bank financial sector, it is our view that some aspects of the measures to restore credit discipline do not go far enough, some seek to duplicate existing practices, and others send conflicting signals to the credit market.

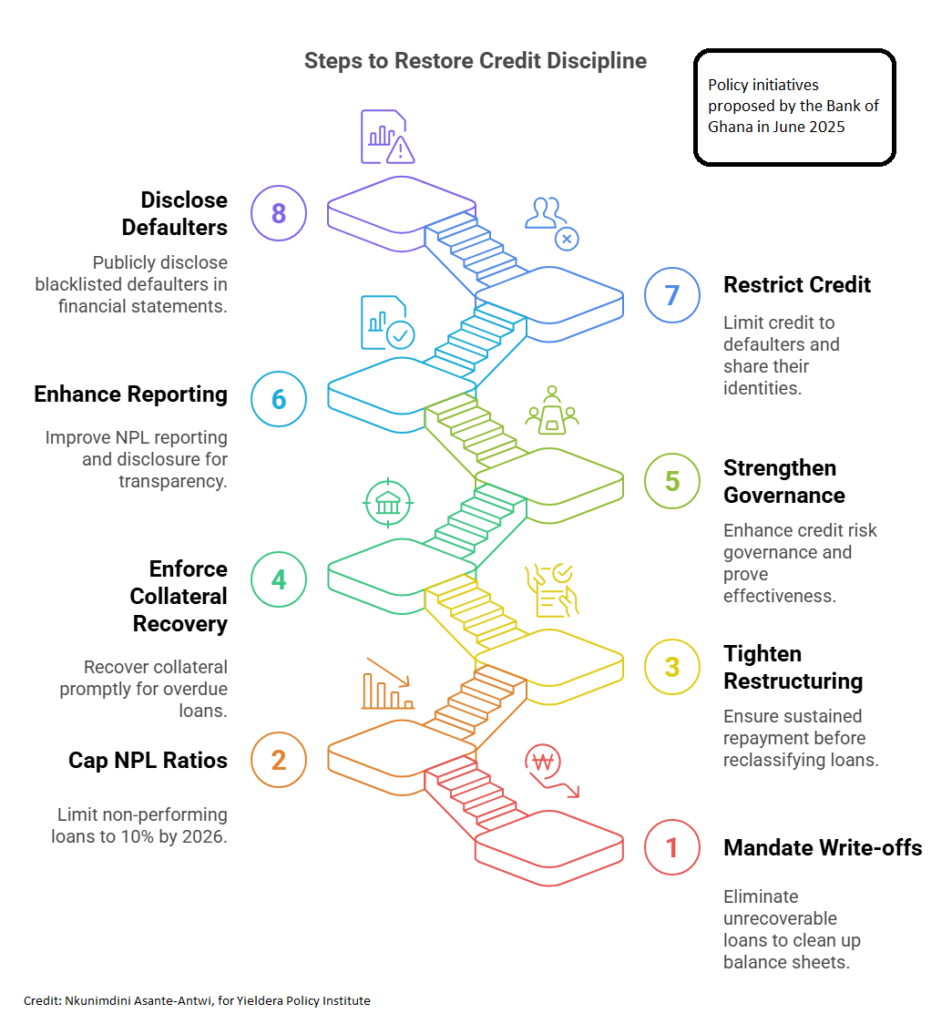

As announced, the following proposed measures are being considered:

- Mandate write-offs of fully provisioned loans with no realistic recovery prospects, excluding related-party exposures.

- Cap NPL ratios at 10% of gross loans by December 2026.

- Tighten restructuring rules, requiring sustained repayment before reclassification.

- Enforce timely collateral recovery, especially for overdue loans.

- Strengthen credit risk governance and require proof of effectiveness.

- Enhance NPL reporting and disclosure, with monthly submissions and public transparency.

- Restrict further credit to strategic or wilful defaulters and share their identities with key financial sector oversight bodies.

- As part of this directive, banks will also be required to disclose blacklisted wilful defaulters in their audited financial statements, along with sectoral breakdowns of NPL exposures.